By Clare Mullen, Executive Director

So, there’s a few spats going on on social media at the moment in relation to health finance. Like on this post on LinkedIn where people representing surgeons, and people representing private health insurers, seem to me to be arguing about which one of them is going to charge the patient for the cost of surgical items.

So – it’s Saturday morning, and I have a bit of time, so I thought I’d try to see what some of these interests might be.

First up – the average salary of a surgeon

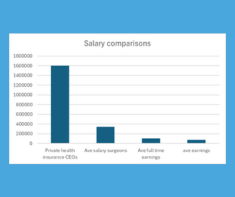

I couldn’t find any publicly funded sources of information from my quick search. But this article from Medrecruit (a medical recruitment firm) say they’ve used Australian Tax Office data to come up with an average taxable salary of $394,000 a year. The same company writes that neurosurgeons – like those who do spine surgery – can earn up to $800,000 a year.

So, between the 2023 article from Medrecruit, and a 2023 article from GlassDoor I feel comfortable reaching the conclusion that:

- the average salary of a surgeon in Australia is around $340,000/year

Then to health insurer profits

The five biggest health insurance companies in Australia, according to the national consumer group Choice Australia are:

- Medibank

- Bupa

- HCF

- NIB

- HBF

So I looked at the most recent annual reports (for 2023) for all of these companies. Some headlines:

- Four of these five companies reported multi-million dollar profits last year – the exception is HBF who reported a loss of $87.7m, down from a loss last year too.

- The average annual profit reported across the four was $344m/year.

- Collectively, they reported profits of $1.3b.

- Two of these five are set up as not-for-profit organisations – HCF (profit of $171.4m) and HBF

And so to the salaries of senior staff in health insurance firms…

I looked at what private health insurers pay their senior staff. (As a passing observation, if I didn’t know better I’d say that these firms don’t want you to work out what their senior staff get paid, because many of the reports make this information as opaque as possible. But I do know better. Except for HCF – they *really* don’t want you to know so they don’t publish it.)

Taking out HCF (because they don’t make that information available online), the average pay for the Chief Executive of the three other health insurance firms that reported a profit (or surplus) is $1.6m a year.

As a comparison, the average for adult full-time earnings in Australia is $101,000/year. When you do a comparison that includes all earners (i.e. including those working part-time), the average annual salary is $74,500.

(And the CEO at HBF is reported as having been paid $731k to June 2023.)

So what?

So what does this mean? Is this just me whingeing about people who work hard to earn their money?

Nope. This is me trying to reconcile the reality of healthcare in this country. Where your socio-economic status determines your health, but where we’re seeing more outrage about which bit of the health system that’s making lots of money for the companies and people involved in providing that healthcare is going to pass on the cost of that healthcare to the people needing the healthcare.

It’s time for full transparency in health finances

As an informed health consumer, I find it really frustrating how challenging it is to find out about the financial interests in health. I want to know if the person or company providing me with care is doing it for my benefit, or for theirs.

This website from the Federal Government is a good start to find out about likely out of pocket costs for treatment you might be considering – https://medicalcostsfinder.health.gov.au/

And as someone who speaks regularly to people who are battling to get access to the healthcare they need – either having to overcome financial challenges, or grapple with bureaucratic processes that seem to have been designed by people who don’t give a fig about the people trying to access healthcare (which I know isn’t true!) – I want to see a much stronger voice for consumers and the community on this issue.

So let’s have full transparency on health finances. A few ideas off the top of my head on this Saturday morning:

- If any healthcare provider receives any public funding (like Medicare), let’s require them to publish information about profits, and any individual salaries over the average annual salary

- If any provider negotiates financial deals – like commission to preferred providers, or incentives for particular types of treatment – let’s require this to be published, and the information be made available to the consumer when they’re making a decision about treatment options

- Along with the Choosing Wisely questions, let’s add a question about “What are the financial implications for you – the provider – in any of the options we’re discussing?”